Source: FactSetĭata are provided 'as is' for informational purposes only and are not intended for trading purposes. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Sources: FactSet, Tullett PrebonĬommodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Sources: FactSet, Tullett PrebonĬurrencies: Currency quotes are updated in real-time. Sources: FactSet, Dow Jonesīonds: Bond quotes are updated in real-time. Sources: FactSet, Dow JonesĮTF Movers: Includes ETFs & ETNs with volume of at least 50,000. Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Overview page represent trading in all U.S. Indexes: Index quotes may be real-time or delayed as per exchange requirements refer to time stamps for information on any delays. Copyright © FactSet Research Systems Inc. Fundamental company data and analyst estimates provided by FactSet. International stock quotes are delayed as per exchange requirements.

stock quotes reflect trades reported through Nasdaq only comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. Additional information can be accessed at or at View source version on businesswire.Stocks: Real-time U.S. Depositary receipts representing common shares of Emera are listed on the Barbados Stock Exchange under the symbol EMABDR and on The Bahamas International Securities Exchange under the symbol EMAB.

Emera’s common and preferred shares are listed on the Toronto Stock Exchange and trade respectively under the symbol EMA, EMA.PR.A, EMA.PR.B, EMA.PR.C, EMA.PR.E, EMA.PR.F, EMA.PR.H, EMA.PR.J and EMA.PR.L. Emera has investments in Canada, the United States and in three Caribbean countries. The company primarily invests in regulated electricity generation and electricity and gas transmission and distribution with a strategic focus on transformation from high carbon to low carbon energy sources. Additional detailed information about these assumptions, risks and uncertainties is included in Emera’s securities regulatory filings, including under the heading “Enterprise Risk and Risk Management” in Emera’s annual Management’s Discussion and Analysis, and under the heading “Principal Financial Risks and Uncertainties” in the notes to Emera’s annual and interim financial statements, which can be found on SEDAR+ at About EmeraĮmera is a geographically diverse energy and services company headquartered in Halifax, Nova Scotia, with approximately $39 billion in assets and 2022 revenues of more than $7.5 billion. There is a risk that predictions, forecasts, conclusions and projections that constitute forward-looking information will not prove to be accurate, that Emera’s assumptions may not be correct and that actual results may differ materially from such forward-looking information.

These statements reflect Emera management’s current beliefs and are based on information currently available to Emera management.

By its nature, forward-looking information requires Emera to make assumptions and is subject to inherent risks and uncertainties.

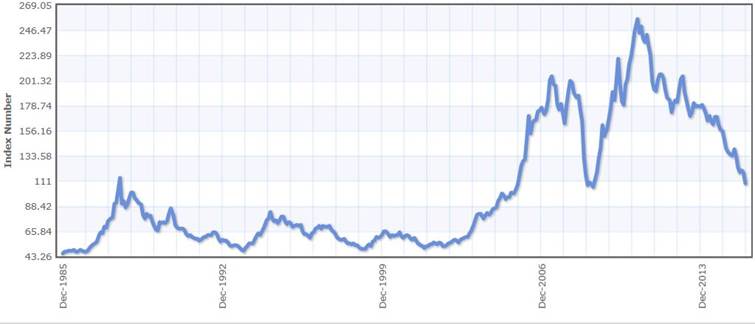

EMERA STOCK TSX SERIES

This news release contains forward-looking information within the meaning of applicable securities laws with respect to Emera, the Series C Shares and the Series D Shares.

0 kommentar(er)

0 kommentar(er)